India’s AI Stack: What Startups Are Using in Production

India's first builder-level survey reveals a market more sophisticated and surprising than expected.

We surveyed 244 AI startup CTOs, developers, and builders in India to understand what is actually being used in production today. The survey focused on deployed tools and real workflows rather than future roadmaps or theoretical preferences. We asked respondents what is currently in their stack, which tools they have dropped over the last six months, and how their choices change when forced to commit to a single LLM provider.

Respondents came from 12 industries. 53% identified as developers or engineers, 37% as founders, with the remainder split between product managers and generalists. Over half of the respondents are building at the pre-seed or stealth stage. 35% reported shipping customer-facing AI features used by more than 1,000 users.

The resulting dataset is a reasonable cross-section of India’s AI builder ecosystem, with an expected skew toward early-stage teams. While some findings align with prevailing assumptions, others meaningfully diverge. A subset of the results has direct implications for anyone building or investing in AI infrastructure for India.

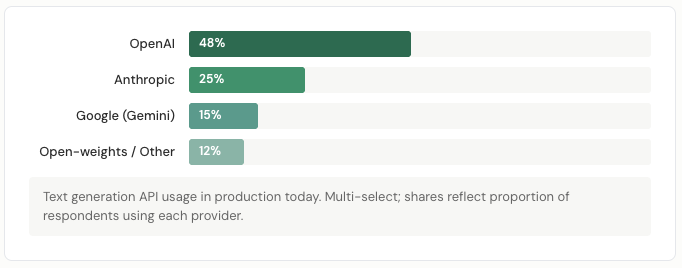

OpenAI dominates the market today

When we asked which text generation APIs people actually use in production today, OpenAI still leads at 48%. Anthropic sits at 25%. Google at 15%. That's the installed base talking. OpenAI got there first, built the integrations, became the default.

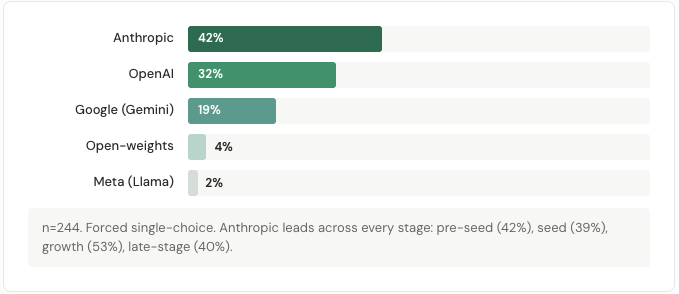

But preferences are shifting to Anthropic

When we asked a different question: if you could use only one LLM provider for the next 12 months, who would you pick?

42% said Anthropic. 32% said OpenAI. 19% said Google.

This isn’t a niche preference among one builder segment. Among teams with live products serving 1,000+ users, it’s 40% Anthropic vs. 31% OpenAI. Among teams stuck in PoC purgatory, Anthropic’s share hits 53%. The forced-choice question captures where preference is moving, and preference is a leading indicator of where spend goes next.

Two things seem to drive this, which we validated from direct discussions with some of the survey respondents:

Claude’s perceived edge in code generation and long-context reasoning matters disproportionately when 49% of Indian builders use coding APIs as a primary workload.

And pricing: Claude 4.5 Sonnet sits at a price-performance point that registers in a market where 41% of builders spend under $600/month on AI infrastructure.

Anthropic seems keen on consolidating a market where they already lead in developer intent by opening up a Bengaluru office and hiring their India head.

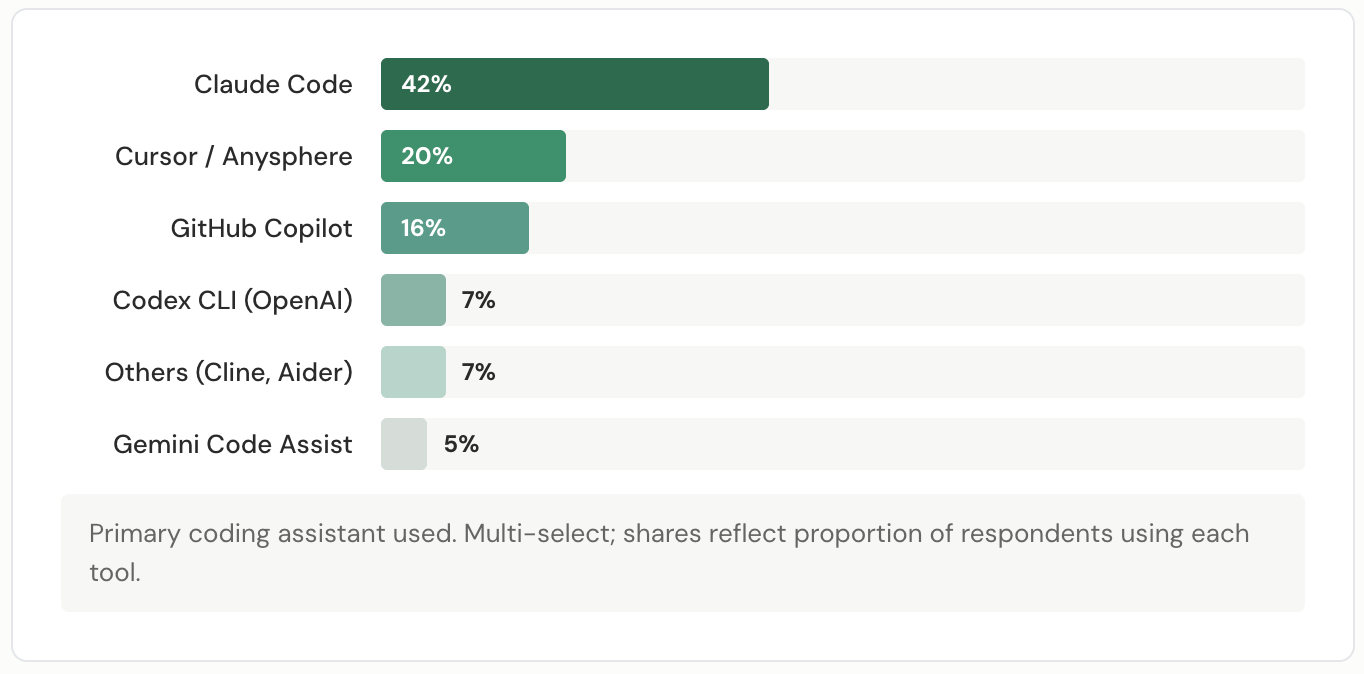

The Great Coding Migration

The most visible shift in India’s AI stack over the past six months is in coding tools.

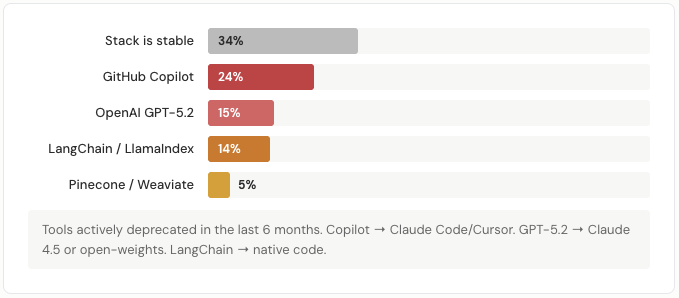

24% of all respondents dropped GitHub Copilot. That was the single most common tool abandoned after “our stack is stable.” When we look at what people use now, Claude Code holds 42% of the coding assistant market among Indian builders. More than Cursor and GitHub Copilot combined.

Copilot was bundled, familiar, and enterprise-approved. It still lost. Developers cite Claude Code’s multi-step execution, codebase-wide navigation, and sustained context amongst the reason for preference. Once the gap became clear, switching costs proved lower than expected.

Three adjacent migrations reinforce this trend.

14% deprecated LangChain in favour of native code, custom frameworks now lead orchestration (40% vs. LangChain’s 34%).

15% moved off GPT-5.2, largely toward Claude 4.5 and open-weight models, driven by price-performance.

And 5% replaced Pinecone or Weaviate with PostgreSQL + pgvector or long-context approaches - small in share, but directionally meaningful.

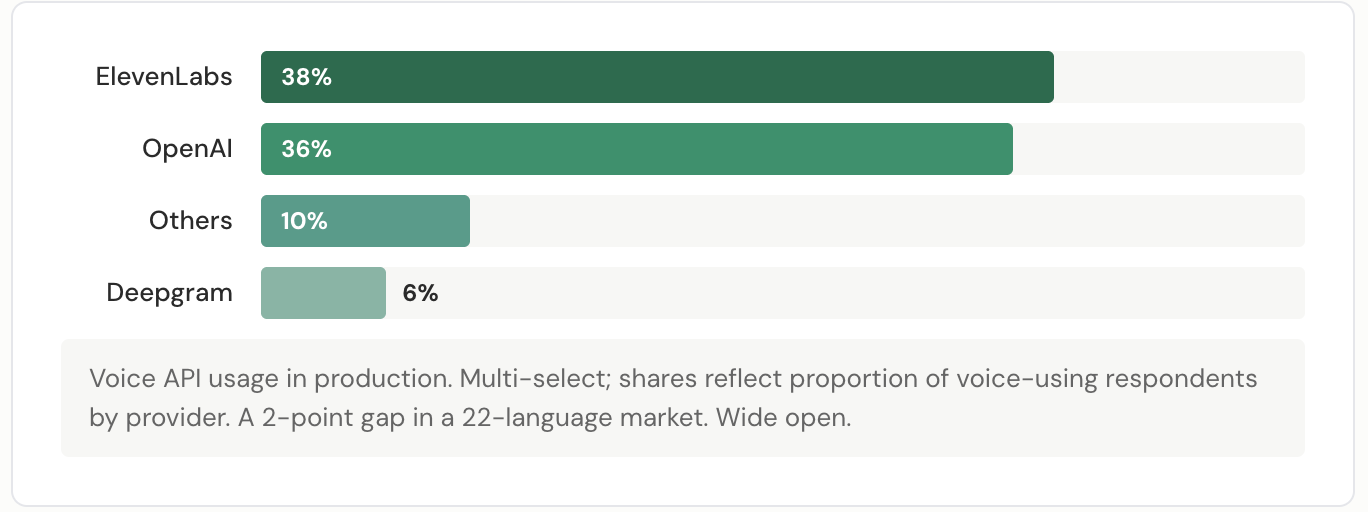

It’s ElevenLabs vs OpenAI in Voice

Voice in India is primary interface for many interactions, both consumer and enterprise-facing. 37% of builders use voice APIs in production. The market is a tight two-way race.

Voice is where the India-specific opportunity concentrates. 22 official languages, voice-first behavior, code-mixing across languages, and low literacy in many segments. No provider has locked this down. The next breakout consumer AI product in India will probably be voice-native.

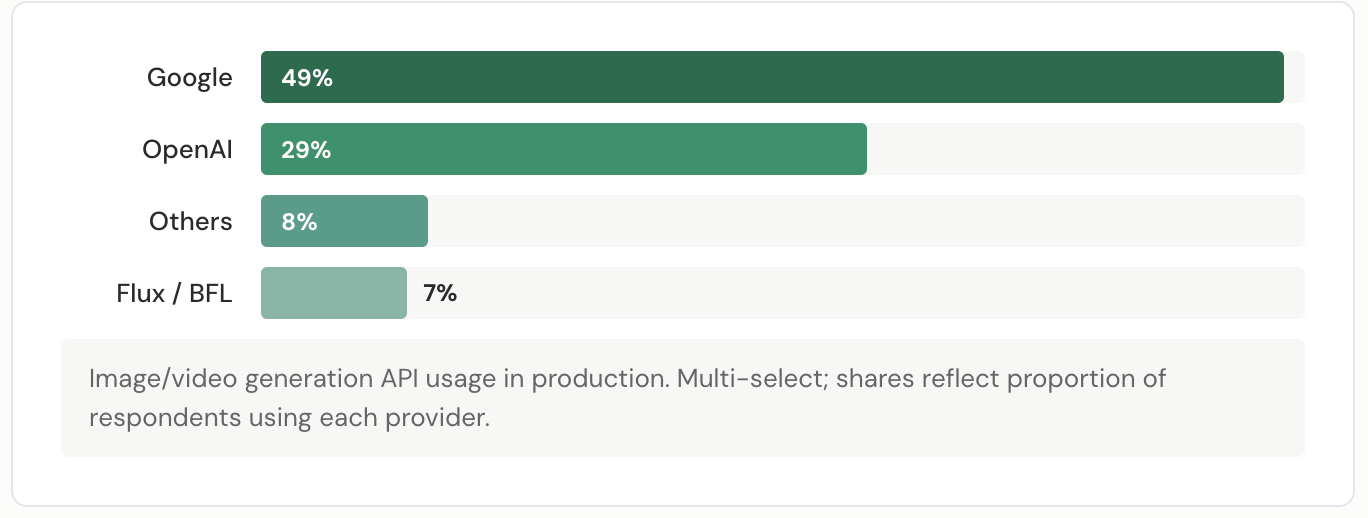

While Google Owns Image & Video Generation

It seems like the image and video generation, the race is already decided. Google holds 49% - nearly as much as the rest of the market combined.

Google's 49% share is driven by Imagen 4, Veo 3, and its distribution footprint across Android and Chrome. This is a distribution-led moat, not a model-quality moat — and it's the hardest kind to dislodge.

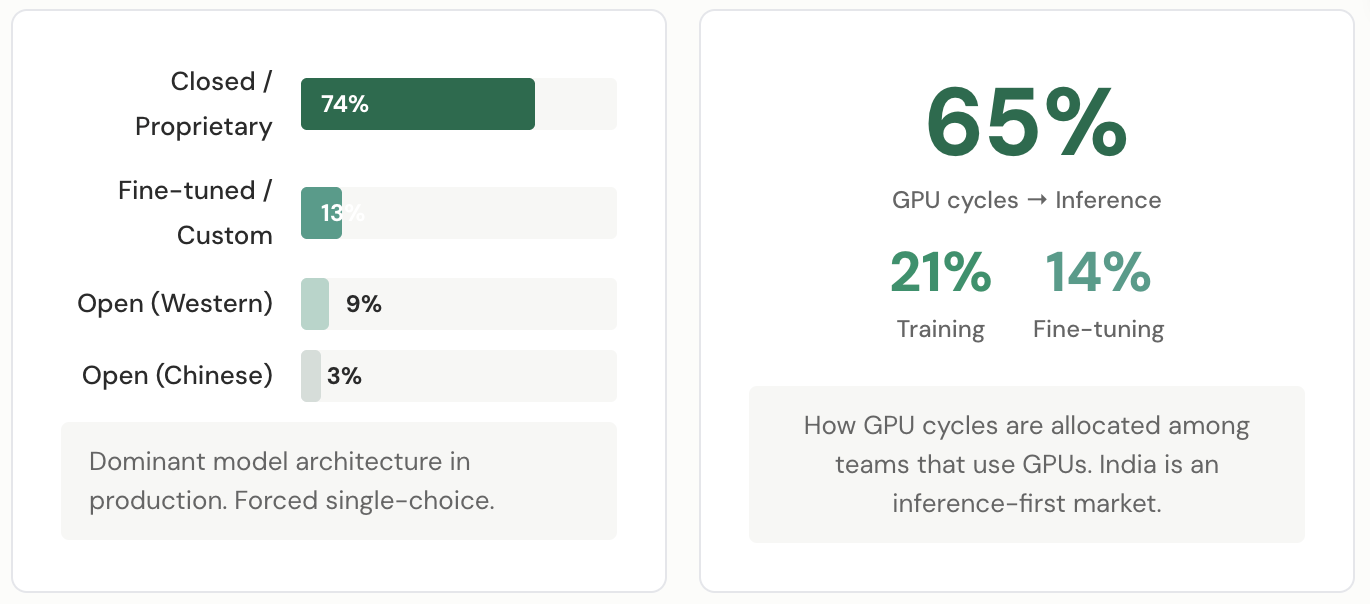

India is API-first, not GPU-first

74% of builders use closed, proprietary models as their dominant architecture. Only 9% run Western open-weights. 3% use Chinese open-weights like DeepSeek or Qwen.

The “open-source India” narrative doesn’t match what’s actually running in production.

83% of builders include model provider APIs as a primary stack component. 30% self-host inference. 65% of GPU cycles go to inference, not training or fine-tuning. The majority of this ecosystem is calling APIs, not training models.

60% of builders spend less than $2,400 a month. Investing in training infrastructure makes less sense every month when you can ride the capability curve by calling an API. The value creation opportunity is at the application and services layer, not the model layer.

For investors, the companies worth backing in India are not the ones with the most GPUs. They’re the ones with the deepest understanding of specific workflows, the most useful proprietary data loops, and the fastest product iteration cycles.

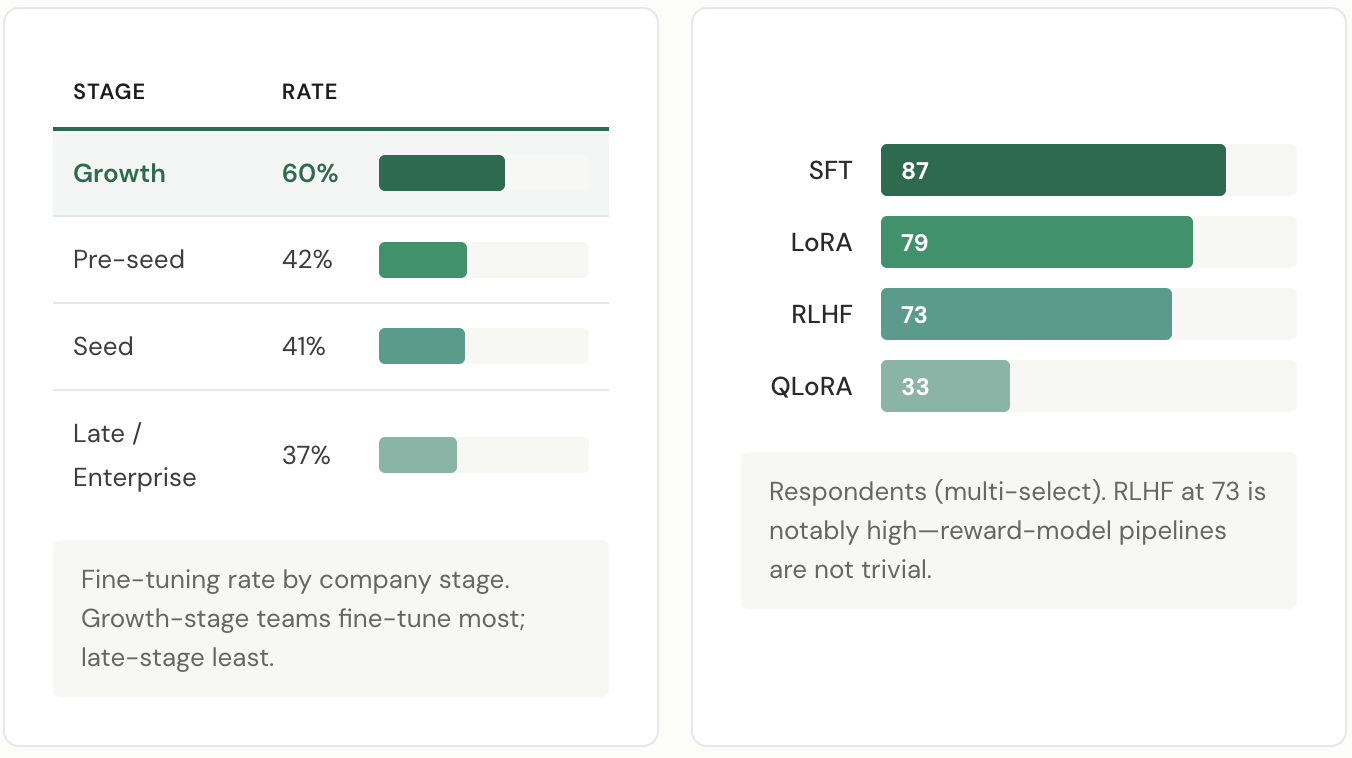

Fine-Tuning Is Real, But Selective

43% of respondents fine-tune their models. Higher than many would expect, but not the majority.

The rate varies by stage in an interesting way.

The growth-stage peak makes intuitive sense. These companies have found product-market fit. They have enough production data to make fine-tuning worthwhile, and enough competitive pressure to justify the investment. Pre-seed teams fine-tune at a surprisingly high rate, probably because many are building AI-native products where model customization is the product itself. Late-stage enterprises fine-tune less, likely relying on prompting, RAG, and off-the-shelf models instead.

Among fine-tuners, the techniques are practical. SFT is the most common full fine-tuning method (87 respondents). LoRA dominates parameter-efficient approaches (79). RLHF is used by 73 respondents, which is worth pausing on. That’s not just casual LoRA experiments. A meaningful subset of Indian builders are implementing reward-model pipelines.

Agentic Workflows: The Unanimous Next Bet

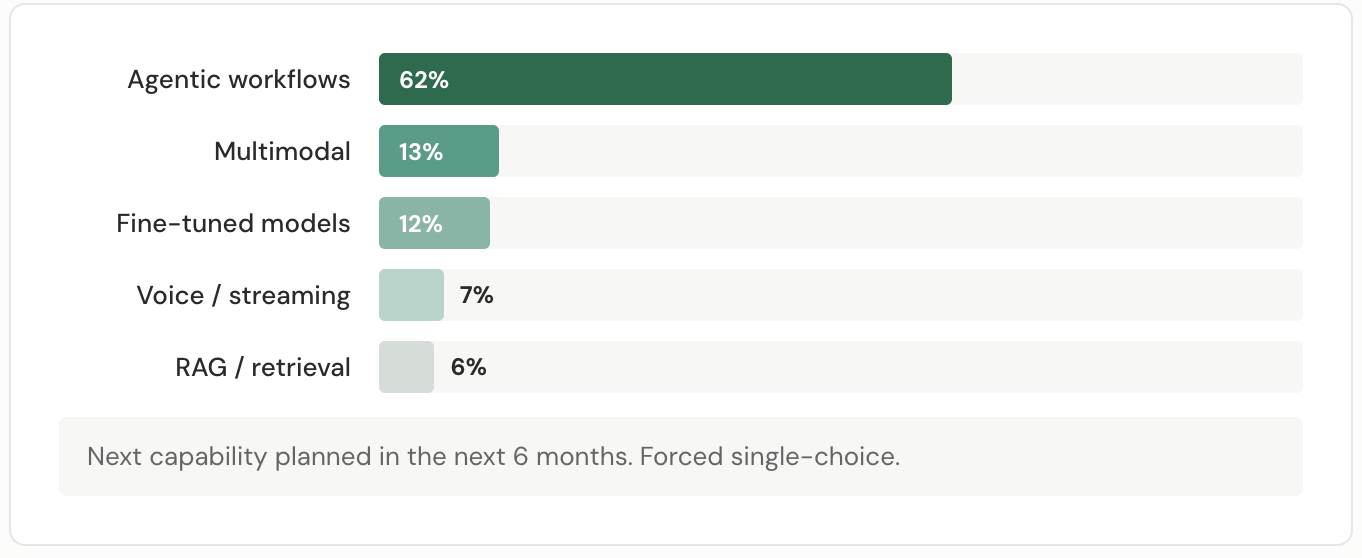

No result in the survey was this skewed. 62% of builders plan to add agentic workflows in the next six months. Every other capability trails far behind.

The direction is logical. Models now support production-grade agents, the use case fits India’s strength in process automation, and agents can command higher pricing by delivering outcomes rather than suggestions.

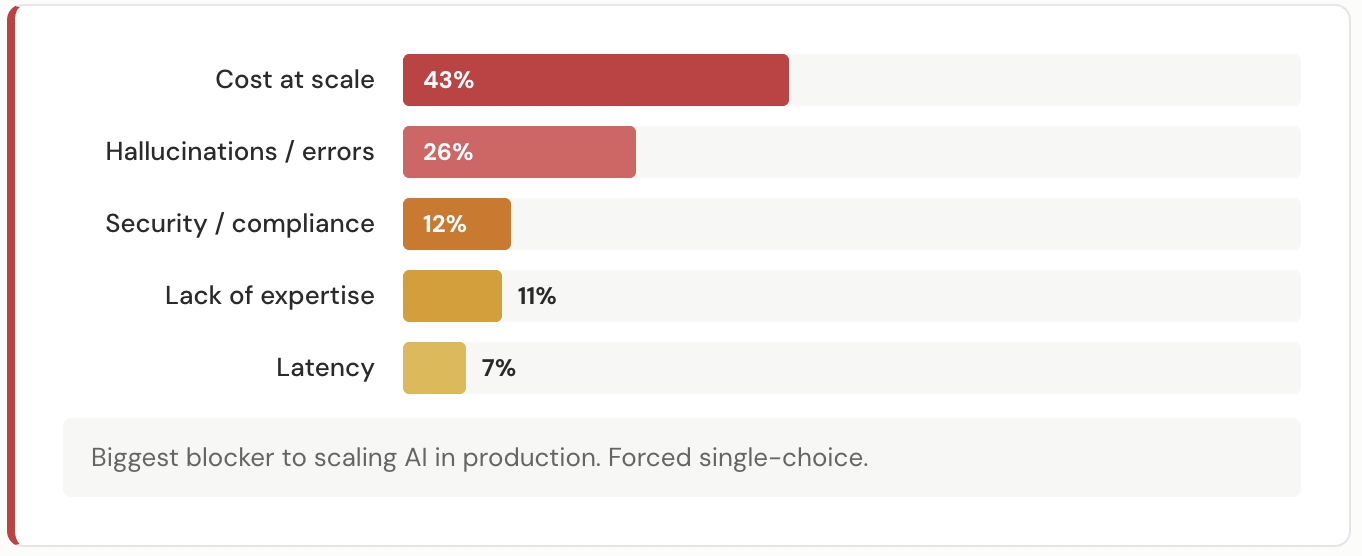

The tension is cost. Agentic workflows are also the most expensive and failure-prone pattern due to multiplying API calls, latency, and error rates. And cost is already the top blocker to adoption (43%).

The ecosystem is racing toward the costliest AI pattern at the moment, cost matters most. Whoever solves for cost per successful task (not cost per API call), wins the middleware layer.

The Non-Technical Blockers

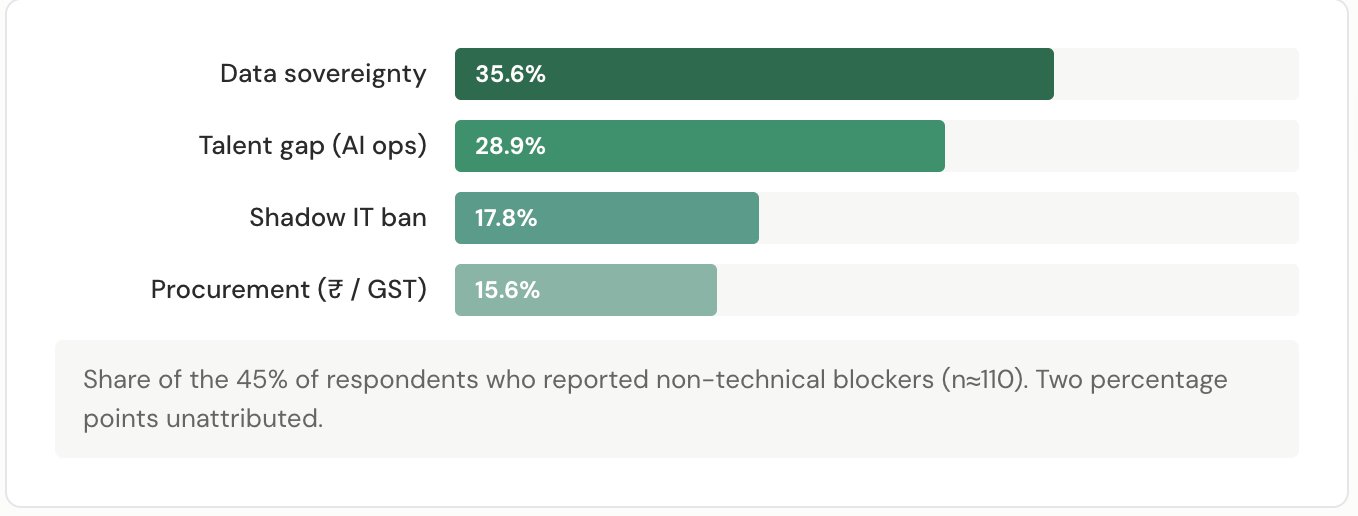

55% said they face no significant non-technical blockers. For the other 45%, the answers matter.

Data sovereignty affects 16% of builders. That’s a structural demand signal for Indian sovereign cloud providers and for model providers willing to offer India-hosted inference.

The talent gap is specific. 13% say they have a budget but can’t find engineers who know how to evaluate and optimize AI systems. India produces plenty of ML engineers. It doesn’t produce enough who understand production AI tradeoffs: cost-quality curves, eval frameworks, latency profiling. This is a different skill set than model building, and training programs haven’t caught up.

The procurement friction at 7% is almost funny in its simplicity. Many US-based AI companies don’t offer rupee billing or GST-compliant invoicing. Indian enterprises with finance teams need clean audit trails. Trivially fixable yet remains unfixed.

What All Of This Means

The provider war is Anthropic’s to lose. They lead in intent, their coding tools dominate, and they’re opening locally. But intent isn’t adoption yet — OpenAI still leads in production API calls. The conversion depends on Anthropic’s enterprise sales motion, pricing, and whether they ship Indic language support and data residency fast enough.

Voice is underpriced. 37% of builders already use voice APIs. The market is fragmented, the demand is structural, and no provider owns it. In a 22-language, voice-first country, whoever cracks multilingual voice AI at scale will build something durable.

Agentic workflows will drive the next wave of enterprise value and the next wave of infrastructure pain. 62% of builders are heading there. Most aren’t ready for what it costs. The companies that solve agent economics—cost per completed task, not cost per API call—will capture the middleware layer.

“Boring stack” companies will outperform. pgvector over Pinecone. Custom code over LangChain. Major cloud over GPU specialists. The companies building on this stack are optimizing for what matters at scale: reliability, cost, and engineering velocity. Investors should be skeptical of tools that add abstraction without proportional value.

The talent bottleneck isn’t in ML engineering. It’s in AI ops. India produces people who can build models. It doesn’t produce enough who can evaluate, optimize, deploy, and monitor AI systems in production. Companies and training programs that address this specific gap have a structural opportunity.

India AI News Roundup

The most impactful AI developments & announcements shaping India in recent weeks.

‘Biggest AI Summit’: Ashwini Vaishnaw Says India AI Impact Summit Getting ‘Phenomenal Response’

Budget 2026: Tax Holiday Until 2047 for Foreign Cloud Companies Using Indian Data Centers

Anthropic Appoints Ex-Microsoft India MD to Lead Bengaluru Office

Up to $100 billion investments may be announced at India AI Impact Summit

Startup Signals

Spotlighting brand new emerging AI startups from India every month, early and undiscovered.

Arrowhead - Voice AI Agents for BFSI Sales

Arrowhead builds human-sounding voice AI agents that handle end-to-end sales conversations for banks, NBFCs, and insurers — calls lasting up to 20 minutes without customers detecting AI. The platform supports 7 Indian languages with mid-call code-switching and claims 45% higher conversion rates than human agents. 50+ clients including Bank of Baroda, Aditya Birla Capital, Paytm. 5x ARR growth Aug–Oct 2025; every PoC has converted to live deployment. $3M seed led by Stellaris; angels include Kunal Shah (CRED) and Madhusudanan R (M2P). Stellaris estimates India’s BFSI voice AI market at $3B with <$50M penetrated.

FPV Labs - Spatial Intelligence Infrastructure for Robotics

FPV Labs is building the data infrastructure for physical AI - capturing human dexterity at scale to train general-purpose robots. The core thesis: language models scaled because the internet had trillions of tokens; robotics has no equivalent data flywheel. Simulation and teleoperation don’t produce the scale, diversity, or edge cases of real-world interaction. FPV is creating that missing layer - capturing the long tail of human physical manipulation as training data for the next generation of humanoids and spatial computing. Incubated from Lossfunk.

Novyte Materials - AI-Powered Materials Discovery

Novyte uses generative AI and physics-based simulation to compress materials discovery from years to weeks. The platform targets specialty chemicals, advanced polymers, paints, adhesives, and coatings — sectors actively seeking alternative materials for performance and sustainability. Closed-loop automation links computational modelling with robotic synthesis. Incubated at ICT-NICE (Institute of Chemical Technology, Mumbai). Raised ₹4.15 Cr pre-seed led by Theia Ventures (backed by British International Investment), with angels from Venwiz and Chemvera. Currently running early pilot projects with manufacturing and aerospace partners.

Survey Methodology

Survey conducted January 20 to February 1, 2026 through Activate’s builder community and broader network. 244 responses across founders, engineers, PMs, and operators building with AI in India. 12 industries, pre-seed through late-stage enterprise. All responses are voluntary and self-reported. Results reflect the composition of respondents and likely overindex on early-stage, technical builders within Activate’s community.

Cursor solved our infra outage in 20 minutes, that could easily have taken more than a day if done manually

This is so good thank you.